Why a Southern Hemisphere Trip Changes Your Investment Perception

Thursday, October 01, 2015

They rent the babies a friend told me!

I just returned back from a 2 week trip to South Africa with my youngest daughter.

I spent all my time in Johannesburg, the city I grew up in.

It was a bittersweet trip for me.

I have not been back to my native country for over 10 years.

No, I’m not on the lamb!

10 years provided me with a rude awakening.

When I left in the 90s the walls around homes were high – they are even higher now.

On top of each monstrous wall is electric fencing … I wondered if all those electric fences were ‘live’ but I didn’t attempt to find out. Given that power outages have become commonplace I’m guessing not all are.

At most busy traffic lights (called Robots) there is a plethora of activity. Street vendors hock anything you can imagine. And there are begging rings. A friend told me they are predominantly Nigerian and the babies are not necessarily there with their mothers. Nope they are ‘rented’ out for the day to generate revenue!

Additionally, the city I knew has now been subsumed into its original African roots. That is, the city I grew up in was strictly segregated and planned in meticulous British style – street grids, fancy gardens and parks. For better or worse the chaos that can be Africa exists where the English colonial system once reigned.

The economy is not in good shape, the Rand has tumbled to close to R14 to $1 which was last seen around 1999 during the Asian financial crisis. However there are positives:

- Johannesburg is truly the gateway into Africa.

- Very cosmopolitan and now home to Africans from all countries on the continent.

- Sandton, the new business district, is humming with energy and activity with the traffic moans and groans to prove it.

- Uber works without a hitch!

- While the markets are volatile, well run corporations are making inroads into the continent and recurring earnings are growing.

The Future as I see it:

I believe Nelson Mandela bestowed an amazing gift on the country, one which will keep on giving long after his passing.

By refusing to allow the country to descend into civil war and embrace reconciliation – a most bitter pill for him to swallow no doubt – he has left a model for others to follow.

I have noticed that good things seem to emerge when enemies unite. Here are some examples:

- Germany after World War II

- Japan after World War II

Today Germany and Japan are strong Allies of the USA to the point where nobody sees them as an enemy anymore and trade is flourishing between former foes.

Contrast this with the Treaty of Versailles where war reparations were forced onto Germany by France, England the USA etc. That short sighted move ultimately bankrupted Germany allowing National Socialism to take root which led to World War II.

South Africa has embraced the former reconciliatory path and although it is a young democracy which will be tested, I believe it will survive.

But for that to happen the masses NEED access to faster internet where the industrious will stream FREE EDUCATION and those with willpower WILL raise themselves above their dogmatic station in life.

As with all things in life this can be seen as an obstacle or an opportunity. I prefer the latter and encourage the backing of investments that seek to achieve this worthy but lofty goal.

In order for Emerging Markets such as South Africa to begin lifting the malaise, the developed economies need to stem their risk of behavior. Which begs the question whether an intermediate rally is brewing and what danger signs to be aware of longer term?

Tradable Rally approaching?

A curious thing is going on with investor sentiment.

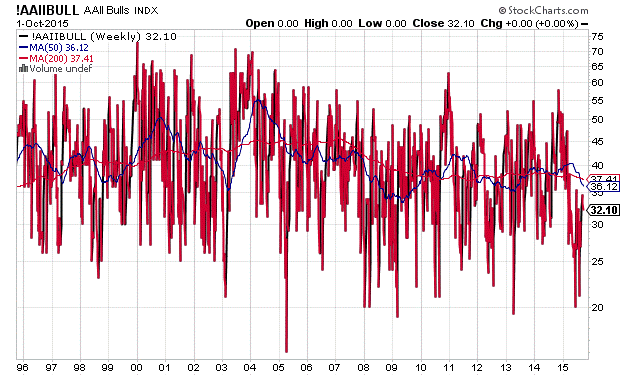

The American Association of Individual Investors (AAII) Sentiment Survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months; individuals are polled from the ranks of the AAII membership on a weekly basis. Only one vote per member is accepted in each weekly voting period.

The AAII Survey is often used as a contrarian indicator that is if investor sentiment is very bullish it indicates that there are not many new buyers left to enter the market and prices could decline and visa-versa for bearish sentiment.

As recently as last week the AAII Bullish sentiment hit levels indicative of 2003 and 2008/09 bear market lows.

Figure 1 – AAII Bullish Sentiment (source: stockcharts)

It seems as if our collective psyche was severely altered by the 2008 market crash. Investors get really nervous, really quickly and given that we’ve ‘only’ had a ~10% correction in the S&P500, the uber low bullish reading is curious – but a good contra-indicator for us to watch out for a rally.

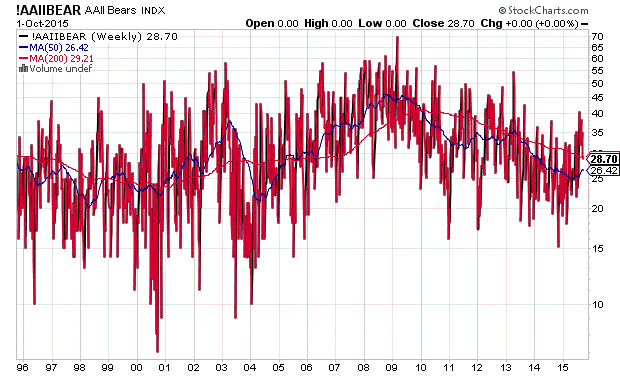

Now here’s where it gets even curioser (is that even a real word?)

If investors as a group are NOT bullish you would think they are therefore bearish?

Not true.

Figure 2 – AAII Bearish Sentiment (source: stockcharts)

The AAII Survey indicates only 28% of investors are bearish. That’s a low reading compared to 60% and 70% at the 2003 and 2008/09 lows respectively.

That implies that a large contingent of investors are neutral or to put it another way, short-term cautious (low bullish percentage) but long-term constructive (low bearish percentage).

We will humbly take the other side of that view given that the AAII Survey is a good contrarian indicator.

This ‘correction’ may be over in the next 2-3 weeks and a good year-end rally will ensue to alleviate low bullish sentiment.

But then we are more concerned over the longer-term mostly because of the preponderance of investment grade bond issuance, some $5.5T* since 2008 and high yield issuance. Again, due to behavioral finance reasons corporate debt has become a crowded trade because investors preferred the safety of debt to equity even though that debt has returned less than the equity for the most part.

Those bonds have been a windfall for investment grade corporations who have taken advantage of historical low rates to lower their cost of capital and buyback stock.

The cause for concern longer-term is therefore a widening of spreads and a potential liquidity contagion if investors come to sell their Bonds and find very few dealers making a market on the other side.

During August/September correction there has been a tightening in credit markets globally

Figure 3 – Source: @Neckar Value, Bloomberg

And corporate CDS spreads are sharply wider

Figure 4 – Source: @MaxDrake007, Bloomberg

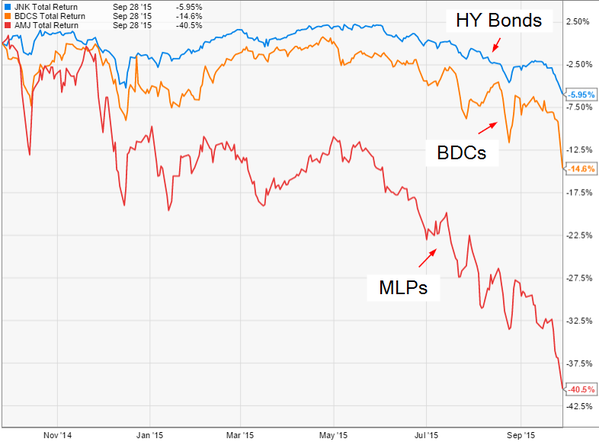

And with pressure in credit markets building, investors are dumping many of the popular spread products. The “reach for yield” has turned into a nightmare

Figure 5 – Source: Ycharts

Pour Conclure

Stronger Dollar, collapsing commodity prices, severe Emerging market pain and higher rates nowhere to be seen … smells like Deflation to me.

#GrowthSlowing

A short term rally may be upon us to relieve the negative sentiment valve … and we will be looking to benefit.

But the downside risk is also building!

REMAIN VIGILENT and be prepared to move SWIFTLY

Regards

Greg

Ps. A lot of readers are asking me for my opinion on the Rugby World …. all I can say for now is it may be a good thing that the Springboks lost to Japan! I ran out of space today but will talk about it next time

* Source: https://www.sifma.org/research/statistics.aspx

—

Thank you for reading my post. I regularly write about private market opportunities and trends. If you would like to read my regular posts feel free to also connect on Linkedin, Twitter or via Atlanta Capital Group.

Greg Silberman is the Chief Investment Officer of Atlanta Capital Group. Atlanta Capital Group specializes in creating custom private market solutions for RIA/Family Office clients and is an active acquirer of independent wealth management practices.

Advisory Services offered through Atlanta Capital Group.

Nothing in this article should be interpreted as a recommendation to buy or sell any security. Please conduct your own due diligence.

Main picture source: Dexter Morgan