Why I Love Christmas In My Bathing Suit

North Bondi surf-club life-savers put up their Christmas decorations at Bondi Beach – a private equity real estate haven …

I lived in the suburb of Bondi Beach, Sydney Australia in the early O’s.

What a gorgeous place!

The Beach, the Coffee, the People – All beautiful.

Good on Ya Mate!

The size and price of property?

Yikes – not so much!

In our 2016 Market Forecast we postulated that this would finally be the year of rising interest rates!

So far this forecast is a bust with the 10-year rate dropping precipitously to a (panic) low of 1.57% in February.

Our thinking has been that Government Bonds would be the recipient of any flight to safety during an equity market sell-off which is indeed how things have worked out — so far.

Despite which we note that yields on Moody’s AAA Investment Grade Bonds are actually HIGHER this year. Confirming our belief that this is a flight to safety and not a pro-credit move.

Our expectation is that equities could fall further during the first half of this year thus keeping rates low(er).

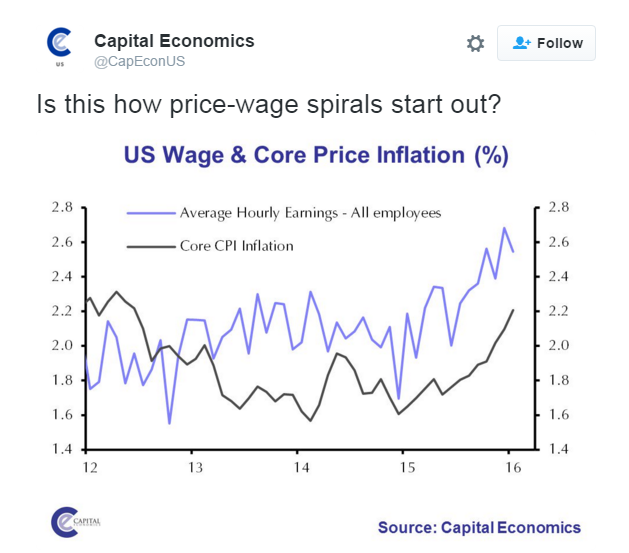

Our thesis for higher rates however was predicated on an unexpected increase in inflation expectations and we cited how national minimum wages had seen incredible hikes simply by edict of elected officials. And long-term rates are highly sensitive to inflation expectations.

Inflation, the price kind (not the expansion of the monetary base) is a surreptitious creature nowhere to be seen one minute and suddenly all-present the next as if by magic.

When we first made our prediction for higher rates because of inflationary fears we were laughed out of the room. That told us we were onto something!

About a month later I received anecdotal evidence from my wife, the primary grocery shopper and not a financial person, who made an interesting comment somewhat out of the blue.

She said, “You know we are spending more money on food recently AND that food prices have been going up?”

Up to that point I hadn’t actually noticed.

But somehow her comments took the veil off my eyes.

She was right of course prices have been moving sneakily higher. It just seems like $20 or $50 doesn’t get you what it did 6 months ago especially when eating out. Perhaps you too have just arrived at that ah ha moment!

Now we knew we were onto something good.

Then 5-days ago the Bureau of Labor Statistics released the January CPI data – core CPI inflation had picked-up to a three-and-a-half-year high of 2.2%!

Core-CPI is defined as CPI ex Food and Energy which makes no sense to us because it is hardly practical but nevertheless, the Fed is suddenly faced with an unexpected increase in CPI despite deflationary conditions globally and a stronger Dollar! Incidentally the increase in core-cpi was from shelter, transportation and medical expenses.

Rising domestic price pressures won’t allow the Fed to leave interest rates at near-zero levels for that much longer. We stand by our prediction that the BIG story of 2016 will be higher rates across the board.

The curious case of Real Estate.

The consensus dialogue regarding real estate goes like this:

If rates are destined to remain low due to global disinflationary pressures and the US is growing at a positive albeit anemic rate, we are as near as dammit to a goldilocks private equity real estate environment — low carrying costs and ok credit quality.

The analog is further reinforced by strong residential markets in most metropolitan areas.

Our instinct says otherwise…

Look don’t listen!

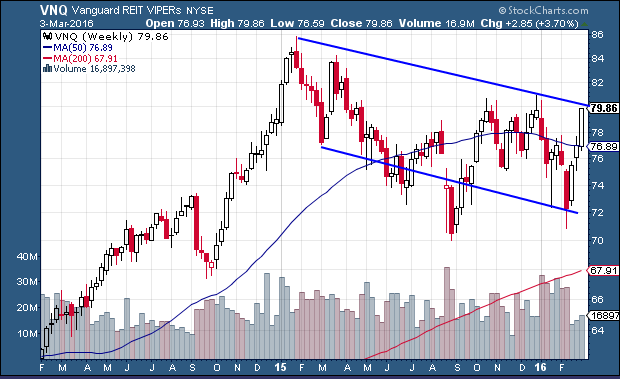

VNQ is a diversified REIT exchange traded fund comprised of exposure to most major real estate sectors. VNQ has been trending lower since the beginning of 2015. Hardly a ringing endorsement for a market pumped up on positive sentiment.

To be fair there are a few mitigating circumstances unrelated to the underlying RE assets such as:

- Listed REIT liquidity issues – As Hedge Funds Struggle, REIT Shares Become Their Victims

- Private Equity Real Estate returns per NCREIF remained positive AND strong in 2015 (but they are less volatile and tend to lag public markets).

- No end in sight for yield based investors soaking up income based investments.

But overvaluation is a problem in many trophy cities. New York, London and Sydney to name a few!

Take a look at this Australian production of 60 minutes — Why Some Think Australia’s Housing Market Is Due for a 2008 Moment .

You will find eerily similar themes to the US resi market circa. 2007/8.

In all fairness, people have been warning about a heated Australian real estate market for more than a decade … all for naught so far!

Here’s another indicator that bears watching.

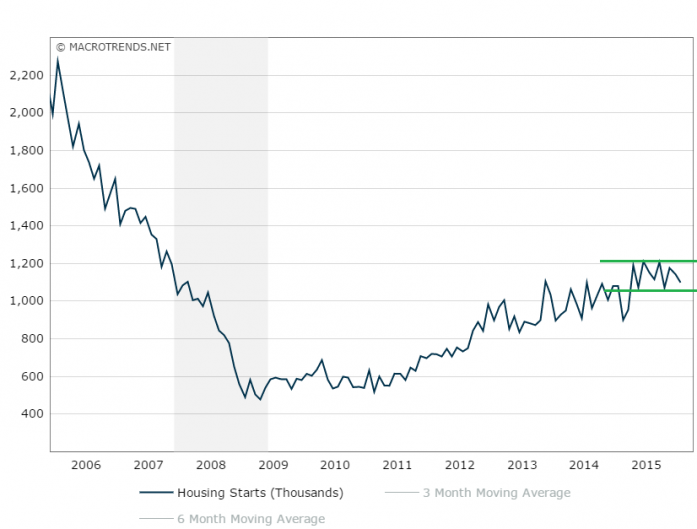

Remember, based on sentiment alone, one would think we are jubilantly breaking ground on more and more new home construction.

Not so…Housing Starts

Housing starts per macrotrends.net peaked in June 2015 at an annualized rate of 1.2 million homes and has been range bound ever since.

What are property developers seeing that the typical investor/homeowner is missing?

“…confidence among homebuilders fell in February amid concerns over “the high cost and lack of availability of lots and labor.” Builders were less optimistic about current sales.” – US housing starts, building permits fall in January

As private equity real estate investors ourselves the Yellow Light (or is it an Orange light?) is blinking CAUTION.

We are more inclined to harvest our private equity real estate investments right now then make new broad allocations.

That said, there are still conservative areas in the private equity real estate market where we see clear opportunities for yield and capital protection.

As always Caveat Emptor!

Greg

—

Thank you for reading my post. Please sign up for our newsletter which contains private investment opportunities and other great information.

Nothing in this article should be interpreted as a recommendation to buy any security. Please consult your financial advisor & conduct your own due diligence.