Bear Market Investing Strategies to Unleash a Dragon

Read about how our strategy shifted to one of capital preservation using bear market investing strategies versus capital growth. Mounting macro headwinds that, in our estimation, shifted probabilities towards a pending equity bear market. We executed this strategy by selling our losers, emerging markets & energy for example, raising cash levels and other bear market investing strategies.

[GS note: make post this date] April 15th 2016

From: CIO Atlanta Capital Group

Re: Market Note to Clients 4/15/2016

Over the last 12 to 18 months our strategy had shifted to one of capital preservation using bear market investing strategies versus capital growth. We had perceived mounting macro headwinds that, in our estimation, shifted probabilities towards a pending equity bear market as opposed to a continuation of this historically long bull market. We executed this strategy by selling our losers, emerging markets & energy for example, raising cash levels and other bear market exposures.

Our resolve was soundly tested in August of 2015 and again in January of 2016 and in both instances we were satisfied with how our portfolios withstood the volatility.

It was thus only natural to expect a March rally to resolve what at the time was a deeply oversold market.

We have now arrived at the juncture where this rally has gone as far as it should go if our bear thesis is valid. Why?

Because from a psychological point of view the market will rally high enough to assuage the Bears of selling short and coerce the Bulls to go long (this is most prevalent in retail buyers at market tops).

We can see that this occurred because various sentiment indicators have moved to levels we expected would create the maximum possible doubt that a bear market is still in force. A tactic often employed successfully by Mr. Market.

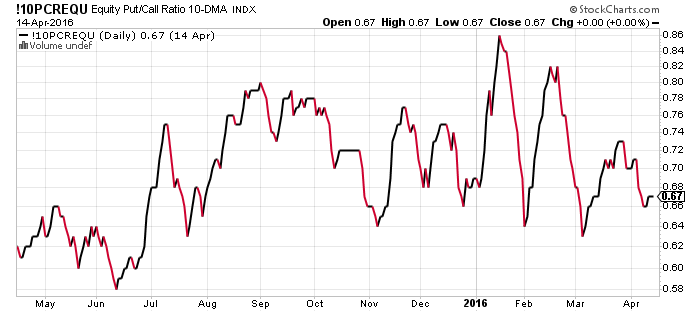

For example the buying of put options versus call options has moved lower, indicating investors are less concerned with downside risk.

1Put Call option buying is moving lower – less need for insurance

img src=”put call option ratio.png” alt=”VIX volatility index”>

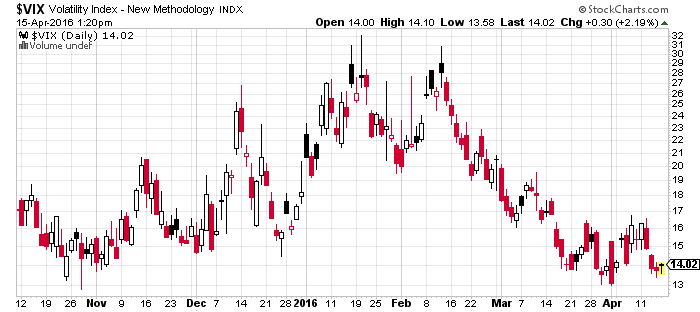

The well-known Fear Index or VIX has moved substantially lower since Jan/Feb volatility and is currently near levels prior to the August 2015 market spill.

VIX volatility index is back to levels pre-market volatility in 2015 and 20162

img src=”VIX volatility index.png” alt=”VIX volatility index is back to levels pre-market volatility in 2015 and 2016″>

If the market were to continue moving higher and assume new all-time highs it is discounting good news we are not aware of but can only surmise … perhaps a rout against terrorism, surprising upside Chinese economic growth or favorable election results?

Nobody really knows.

Under that scenario we will begin putting cash back to work.

Our higher probability scenario is for the market to reverse lower and that is how we are best positioned.

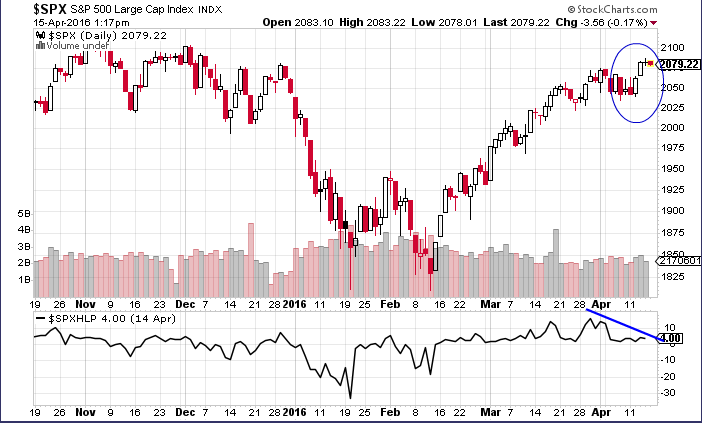

Despite higher equity prices, this rally continues to narrow as can be seen by the percentage of advancers versus decliners moving lower – less securities are participating in higher prices.

3despite higher S&P500 (blue circle) the percentage of securities advancing verse declining is waning – not a healthy sign

img src=”spy.png” alt=”

despite higher S&P500 (blue circle) the percentage of securities advancing verse declining is waning – not a healthy sign”>

Understand that we are referring to degrees of investment not a binary outcome of whether we are for 100% in cash and 0% in equities.

We encourage our clients to keep an up-to-date financial plan with us. In that way we are always cognizant of the long-term ranges that you will need to hold in various asset classes. At times such as these we would be at the lower end of the equity range, higher end of the bond and cash range.

Right now is when our own determination is tested the most and we feel we work the hardest in safeguarding your future.

Sit tight!

Greg

—

Thank you for reading my post. I regularly write about private market opportunities and trends. If you would like to read my regular posts feel free to also connect on LinkedIn, Twitter or via Atlanta Capital Group.

Greg Silberman is the Chief Investment Officer of Atlanta Capital Group. Atlanta Capital Group specializes in creating custom private market solutions for RIA/Family Office clients and is an active acquirer of independent wealth management practices.

Advisory Services offered through Atlanta Capital Group.

Securities offered through Triad Advisors, Member FINRA / SIPC.

Atlanta Capital Group is not affiliated with Triad Advisors

Nothing in this article should be interpreted as a recommendation to buy any security. Please conduct your own due diligence.

Main pic: Unleashed by David Meier