2 Reasons Trumpanomics Will Not Deliver

Curt Cobain was a prophet.

{Many people most likely.}

Turns out the above quote is a hoax.

But this Tweet by the President-elect was not:

“I’m saying that the Tea Party, perhaps by another name, will soon have another big moment – and will be a major factor in victory!” Donald Trump, February 24th, 2013

Or this one:

“Republicans better start listening to and respecting the Tea Party!” Donald Trump, February 23rd, 2013

WE ARE NOT POLITICIANS AND WE DON’T TAKE SIDES!

We are merely financial analysts trying to decipher how events will impact equities, bonds and currencies.

What did happen to the Tea Party?

Their message of fiscal conservatism and social liberalism echoed into the embodiment of the President elect.

Here’s what we think:

- Wealth inequality brought about by the Fed’s suppression of interest rates favored the asset rich over the asset poor and brought about large social dissatisfaction.;

- Technology rapidly made redundant large swathes of blue and some white collar jobs. Breeding further social discord. Unemployment is now at 4.6% Participation rate at 62.7% (a 37-year low). Soon Unemployment will be AT ZERO AND NOBODY WILL BE WORKING!

- Brexit demonstrated to the world that populism was growing and the media was not reporting on it (polls) or maybe just ignoring it. Social media however was not censored and people turned to it for coverage.

Donald Trump is the consummate salesman and was able to tap into these sources of dissatisfaction to position himself as the victor.

Tallyho!

“The people quietly wielded their enormous power” — Walter Mondale

From our 2016 market forecast:

How this fits into the current economic picture is unclear. How many election ‘promises’ were pandering as opposed to real actionable issues? We will no doubt find out.

We have seen much analysis on the ‘winners’ in a Trump administration so we won’t rehash but point readers to Never bet against Donald J. Trump by Ziad Abdelnour a fellow contrarian!

For our ramblings we prefer to focus where the crowd is not looking …. Asking ourselves the question:

Is it the man that makes the times or the times that makes the man?

From our 2016 Market forecast (pub. January 2016)

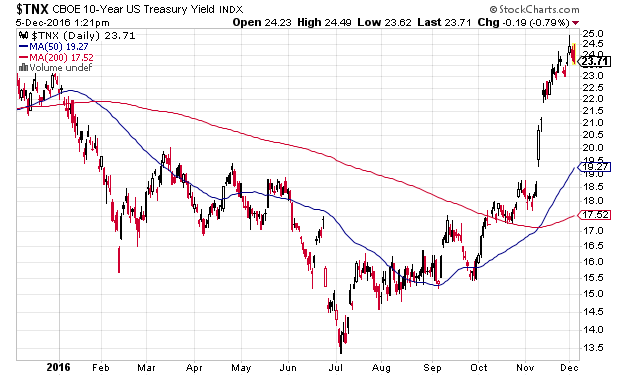

“In a recent article, A Painstaking Move Ahead for 30-Yr Interest Rates, we postulated that long-term interest rates could correct higher merely as a consequence of its 25-year price pattern oscillating within a rising band. This may or may not be the long awaited bear market in bonds but merely a natural corrective action of a market that breathes in and out.

That said, such an oscillation could easily take the 10-year rate to 3.0% and as high as 3.5% — for our prediction we will take the mid-point at 3.25% by the end of 2016.”

Boy we sure looked wrong most of the year on that call.

But since the November 8th elections the long-bond has had a head of steam (more deficit spending?) and the 10-year is at 2.4% as we write.

Still well shy of our 3 – 3.5% forecast.

Figure 1 – 10-year rates moving swiftly higher since 8th November

So while the equity market is busy weighing up the winners and losers from the ‘surprise’ election (we weren’t surprised just for the record).

We are pondering the effect of a 78 basis point increase in the risk free Treasury rate on $65 Trillion of Debt Market securities.

That’s an increase of $507B in interest expense looking out 1 to 2 years! About 20% of that will land on corporate income statements.

Taken in conjunction with this analysis by our friend Garic Moran of TG Moran Capital we don’t believe the picture is as rosy as everyone makes out;

“Corporate profit margins have always reverted to the mean; wages will go higher over time, inflation will follow. There will be winners and losers inside the S&P 500 index, something passive investors [GS: ETFs] cannot analyze.

Companies who have borrowed money to buy back stock or make acquisitions while outsourcing their manufacturing are clear losers.

Domestic companies with high tax rates and are in a position to benefit from infrastructure spending are clear beneficiaries. [GS; Mid-Stream Energy?]

Two More Factors worth consider:

- The current Bull market is the second longest in history at 2,827 days (the longest being 1987 – 2000 @ 4,494 days). The old adage of trees don’t grow to the sky may be applicable.

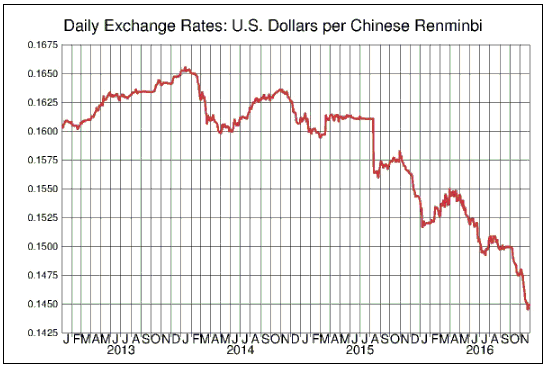

The devaluation of the Chinese Yuan has been relentless. Once thought to be the onset of financial doom, this depreciation has taken place without so much as a ripple.

Figure 2: Source – Pacific Exchange Rate Service

Chinese reserve holdings of US Treasuries have decreased implying the government is selling Treasuries in order to prop up the currency but it’s not working.

“Did China ask us if it was OK to devalue their currency (making it hard for our companies to compete), heavily tax our products going into their country (the U.S. doesn’t tax them) or to build a massive military complex in the middle of the South China Sea? I don’t think so!” President-elect Donald Trump tweeted on Sunday after it was reported that China was upset with his phone call to Taiwanese President Tsai Ing-wen, the first by an American President or President-elect in more than 30 years.

Donald Trump tweet – 12/4/16

So risks abound!

Best not to get over exuberant with this current leg-up in equities, but remain somewhat balanced and close to strategic weights!

Best

Greg

—

Nothing in this article should be interpreted as a recommendation to buy any security. Please consult your financial advisor & conduct your own due diligence.

Greg Silberman is the Chief Investment Officer of Atlanta Capital Group Investment Management [ACGIM]. Atlanta Capital Group Investment Management specializes in creating custom private market solutions for RIA/Family Office clients