When Toiling in Obscurity Leads to Greatness

The sun is shining, as it’s always done

Coffin dust is the fate of everyone

Talking ’bout the rich folks

The poor create the rich hoax

- Blue Oyster Cult

- Jethro Tull

- Led Zeppelin (ahhh Zep!)

- The Clash (London Calling)

Such was my musical education…

When I was a wee Lad, maybe 10 or 11, my older brother SPUN records for me.

He FORCED me to sit & listen. To listen for hours on end.

At the pain of a dead leg or Lummee punch to the shoulder, resistance was futile!

And so it was I developed my taste for music.

One ditty that stood out was by this guy named Rodriquez.

An eloquent poet, he played a ballad I especially liked called Sugar Man;

Seems I wasn’t alone, millions of White South Africans were also ‘tired of these scenes” and longed for “those colors [of] my dreams.”

As the story goes, Rodriquez plied his trade in song for all but naught! Selling maybe 6 records before retiring to a life of obscurity and hard menial labor to the inner burbs of Detroit. Unbeknownst to him, his status had risen to that of Elvis Presley in South Africa during the 70s and 80s. While that country was in lock-down. No news came in or out under heavy sanctions and censorship.

Folk ‘lore in Africa had it that Rodriquez committed suicide, no less on stage, by lighting himself on fire.

So 2 South African boytjies (a colloquial term of fondness for 2 grown men) in the 90s decided to find out exactly what did happen to Rodriquez?

Only to find out he was actually very much alive. And well!

The magic ultimately occurred in 1998 when Rodriquez played his first concert in Cape Town, South Africa to a crowd of thousands.

You can’t make this story up!

Its elegance and beauty are captured in the 2012 movie aptly titled Searching for Sugar Man (available on Amazon and YouTube) and has some great footage of Cape Town.

Thinking about it, this information blanket is highly unlikely to happen in this day and age. The ever- present internet and mobile devices all but eliminate it from occurring.

Don’t Let the Truth Get in the Way of a Good Story

In its simplest form, a lack of information, for whatever reason, creates inefficiencies and anomalies in every facet of mankind.

None more so than in that magnificent beast we call the market…

Take present conditions for example:

Every Monday morning I compile a list of Bullish and Bearish Indicators for our Partners meeting.

At the beginning of May it looked something like this:

OVERALL READING: BEARISH

2. Sentiment, as evidenced by the unusually high level of bullishness in the Investors Intelligence (II) bull/bear ratio. This is a statically significant contrarian signal. As in, if everyone is Bullish who is left to come in and buy? [BEARISH]

3. The weakness in the T-Bond market. Nobody is mentioning rising LIBOR or 3-month T-bill rates. A 1% increase in short-term T-bills will tack on an extra $1.5 Trillion in interest payments on the national debt. Where will that money come from? [Long-term BEARISH]

4. The depletion of the US Treasury’s cash reserve and the “debt ceiling” issue. [GS: The debt ceiling issue will most likely be resolved by time this piece is published. Government officials may wrangle over authorizing the issuance of more debt but, would you bite the hand that feeds? Ofcourse not. Politicians will resolve to continue getting paid.]

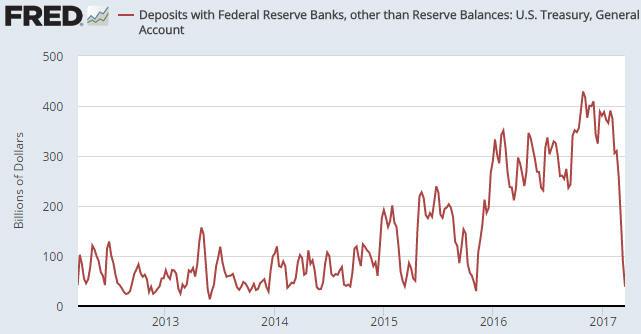

The Treasuries cash reserve holdings is a puzzle worth mentioning:

This indicator tracks, as the name implies, the amount of cash the treasury has with the Federal Reserve. [Briefly, the Treasury issues Bonds to the Federal Reserve for Cash that is used to fund government expenses, programs etc.]

Almost to the day, 8th November 2016, the election of Donald Trump coincided with the Treasury drawing down heavily on its cash balance.

Where did all the money go?

I’m not sure, perhaps they bought ETFs!

The fact is the Treasury is low on cash and the borrowing ceiling does not allow them to issue more bonds. All of which can be resolved by the stroke of a pen … save for some fiscal Republican hawks preventing the edict.

The fact remains, there is no EMERGENCY cash set aside for a rainy day right now [BEARISH]

5. The downside breakout in the oil price and the signs of weakness in the industrial metals markets – BEARISH

6. Regime uncertainty – North Korea, Immigration, Terrorism, repeal Obamacare, Tax reform … let’s call it the Donald factor [potentially Bullish and Bearish but markets hate unpredictability BEARISH]

7. The market rally has become progressively narrower and narrower. The chart below shows the market weighted S&P500 versus an equally weighted S&P500. When the chart line is falling it is indicating that the larger issues are carrying the market higher at the expense of smaller constituents (as opposed to the entire market rising at same time). This rally is becoming narrower something that occurs closer to the end of a bull run. [BEARISH]

FYI Google, Amazon, Apple and Facebook comprise a whopping 21% of The Russell 1000 index.

I get it;

It’s unfair to harp on the bearish side of the ledger.

And markets certainly can and do CLIMB A WALL OF WORRY. But it seems there is a MAJOR disconnect between fundamentals and price. An indication that MASS PSYCHOLOGY rules the roost right now.

Despite our negative outlook, markets have the final say.

It’s important for us to make a partial retreat from our bearish position, temporarily at least. It’s much easier to be objective when we don’t have a lot at stake.

Anyone for some good ‘ol fashioned Equity Market Neutral???

Sugar Man?

Sugar Man?

—

Thank you for reading my post. I regularly write about private market opportunities and trends. If you would like to read my regular posts feel free to also connect on LinkedIn, Twitter or via Atlanta Capital Group Investment Management.

Nothing in this article should be interpreted as a recommendation to buy any security. Please conduct your own due diligence.

Greg Silberman is the Chief Investment Officer of Atlanta Capital Group Investment Management [ACGIM]. Atlanta Capital Group Investment Management specializes in creating custom private market solutions for RIA/Family Office clients.

Advisory Services offered through Atlanta Capital Group Investment Management.