2 Painstaking Reasons the Market can expect a Midlife Crisis

Could the markets be facing a stock market crisis?

In our last market note (How to Unleash a Dragon) we commented that a rally in March was expected given the degree of selling in January and part of February.

The magnitude and breadth of the rebound has surprised us but short covering rallies are normally quite breathtaking.

Our suspicions of a short-covering rally were confirmed in a note from JP Morgan’s Prime Brokerage unit which read:

“JPM’s prime brokerage team saw heavy short covering across all sectors adding additional upward pressure, “particularly with respect to single names that had been oversold earlier in the year.” JPM’s report goes on to note that, “March brought the heaviest net covering seen by the Prime Brokerage in several years.”

GS comment: JP Morgan is one of the largest hedge fund prime brokers in the world. Given the recent fallout in hedge fund darlings such as Valeant and Sun Edison we are led to believe that hedge funds have received large redemption requests and to fund them they have had to trim their longs and buyback their shorts.

We are reminded of the famous Ben Graham quote:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

In fact a stock market crisis is seldom fundamentally driven but more often technical or liquidity orientated. Typically investors realize that their greed has led them into an overvalued crowded trade and as they rush to the exits, fundamental valuations temporarily give way to emotions such as fear.

Now that the rebound is advanced we are left with the question of whether the weighing machine is in balance or out of kilter.

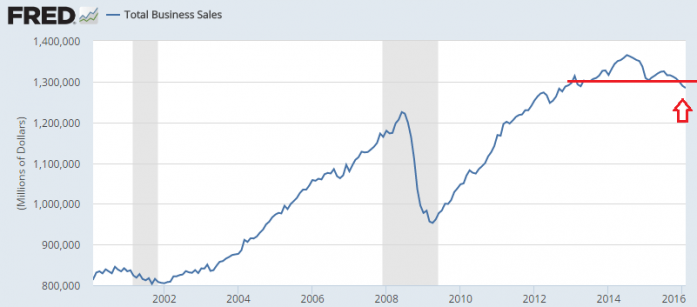

Total Business Sales indicates out of kilter.

Having peaked in August 2014 total business sales has been on the decline and recently moved to new lows. The trend here is lower until further information comes to light.

And while sales have slowed –

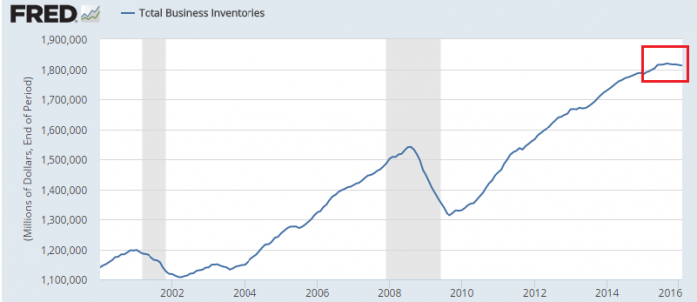

Total Business Inventories have continued to build

If we squint at the data we could postulate inventories have leveled out since about July 2015.

Essentially high business inventories and low sales is a potential signal of a recession – the stuff a stock market crisis is made of.

So we are left with 2 conclusions.

The short covering rally will be over soon and the weighing machine will reassert itself on the downside;

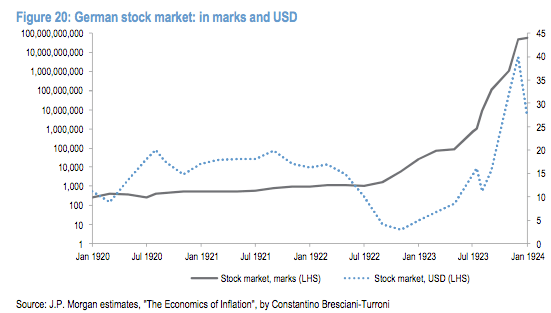

Global stimulus aka. money printing is floating asset prices higher despite poor fundamentals. As my friend Garic Moran of TG Moran Capital reminded me Germany’s stock market did great under similar conditions during the 1920s hyperinflation!

The beauty is that the market will have to reveal its hand soon because this rebound is stretched in both time and magnitude.

Best

Greg

—

Thank you for reading my post. Please sign up for our newsletter which contains private investment opportunities and other great information.

Nothing in this article should be interpreted as a recommendation to buy any security. Please consult your financial advisor & conduct your own due diligence.