“Ipsa scientia potestas est” said one great thinker, which translated, meant in knowledge itself is power. In today’s global quest for power, everyone is looking into the sky for the answer. And no, it’s not blue sky thinking, but satellites. While we have the one Hubble looking out into the universe, we have hundreds more pointing back at us. These earth-facing satellites tells us stories of ourselves that we could otherwise not know. Here are ways these eyes in the sky impact human lives and investments.

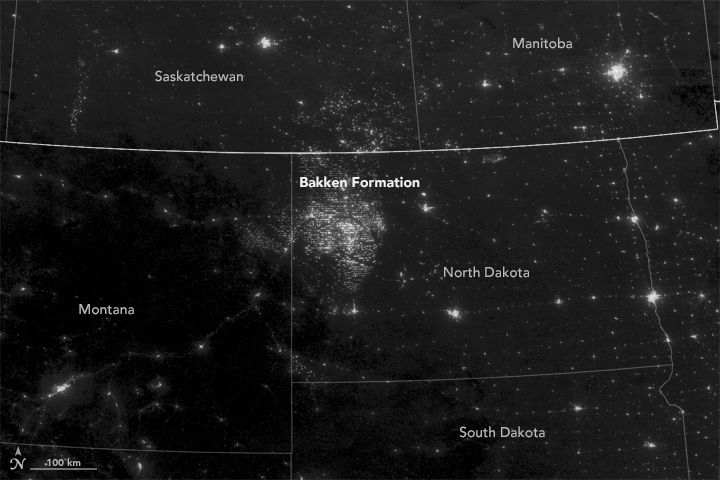

- Estimating global oil inventories

Oil inventory is one application of satellites. Ursa Space Systems can estimate oil inventory globally using proprietary algorithm and space images. This is important as official state figures are deliberately inaccurate. This is for national security reasons. Hence, it helps investors to know what exactly is in storage. Low storage means high demand. Inversely, high storage means oversupply and potential price drop.

- Forests and woods

The rate of deforestation is another area of interest. Imazon provides government with imagery showing the rate of deforestation of the Amazon. This helps policy makers to understand the severity and rate of deforestation. Investors can use this information to assess the risks of policies against their portfolio.

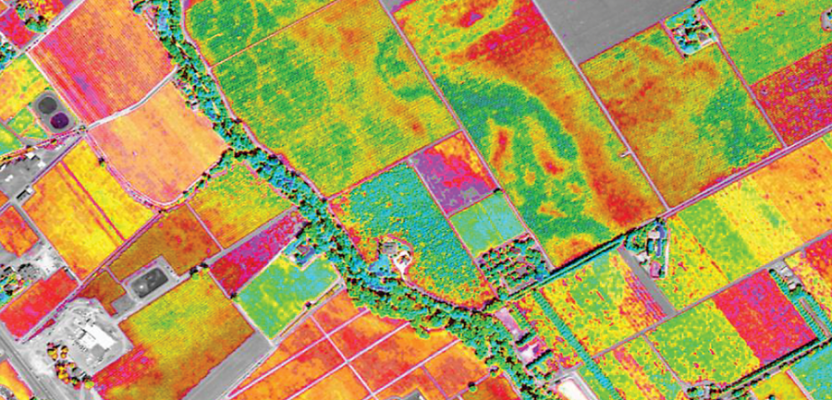

- Farms and Crops

On the flip side of deforestation is agricultural data. TellusLab Inc specializes in rationalizing satellite data to understand and estimate crop yields. This started with soy and wheat has expanded into palm oil, coffee and cocoa. These data helps commodity investors to hedge against a particular crop and country.

- Surveying oil fields

Iceye is a unique satellite system helping oil producers unlock trapped oil and gas reserves in cold environment. This system can pinpoint where the permafrost is melting and releasing trapped natural gas. This takes away all the guesswork of Artic oil and gas exploration. This level of certainty gives investors confidence in their related portfolio.

- Global fishing activities

Fishing is one area satellites help both private sector and public sector. NGOs like Global Fishing Watch use satellite data to map vessels, location and rate of fishing. Vessels that fish in non-fishing zones are reported to the authorities for swift action. In general, this data helps investors to predict the trends in fishing supply and demands. Where there is over-fishing, prices will drop. After some time, the inevitable correction will kick-in for a strong buy.

Time to fishing for the right stocks then!

- Urban Development with satellite guidance

Urban development has high impact on human lives. A poor design could lead to high loss of lives. However, if done well, it could make a city into a powerhouse. Using images from NASA’s Landsat and the European Space Agency’s Sentinel-1 satellite programs, World Bank researchers track expansion of urban cities. It helps town planners to understand potential risks. It also helps economists and policy makers understand the impact of urban expansion. So, when disaster strikes, investors can assess the impact on their investments.

- Satellites on a budget

SpaceKnow offers a DIY spatial analytics platform approach to use of satellites. It can track number of cars in a parking up to shipping vessels and shipping lines. Any investors inclined in specific companies or industries can order custom reports. This is the sort of powerful tools investors can play with today. It’s like having your own satellite without the hassle.

Besides helping investors make sound decisions, satellite also help governments and NGOs. They use the power of satellites to observe climate change and biohazards such as virus spreads. Even pilots use tools like EarthCast to predict actual turbulence during their flights.

The next time you look up the skies, smile. You don’t know who’s looking back at you.

—

Thank you for reading my post. I regularly write about private market opportunities and trends. If you would like to read my regular posts feel free to also connect on LinkedIn, Twitter or via Atlanta Capital Group Investment Management.

Greg Silberman is the Chief Investment Officer of ACG Investment Management LLC (“ACGIM”). ACGIM specializes in creating custom private market solutions for RIA/Family Office clients.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. It is not possible to directly invest in an index. An index fund is a type of mutual fund with a portfolio constructed to match or track the components of an index. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. Advisory Services offered through ACG Investment Management, LLC. ACG Investment Management is an affiliate of ACG Wealth Inc.